Overview

Share transfer is the process through which ownership of shares of a company is transferred from one person to another. In a private limited company, shares are generally transferable but subject to restrictions mentioned in the Articles of Association. In a public limited company, shares are freely transferable unless specifically restricted. The procedure for share transfer is governed under the Companies Act, 2013 and regulated by the Ministry of Corporate Affairs.

A share transfer usually takes place when an existing shareholder wants to exit the company, introduce a new investor, restructure shareholding among promoters, or comply with investment agreements. In private companies, the right of first refusal clause is commonly applicable, which means existing shareholders are given the first opportunity to purchase the shares before they are offered to an outsider. The process must be done carefully to avoid future disputes.

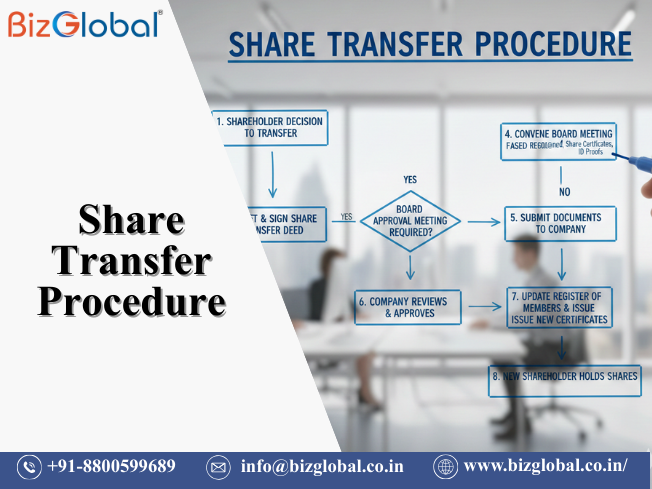

The procedure involves execution of a Share Transfer Deed in Form SH 4, payment of appropriate stamp duty, submission of documents to the company and approval by the Board of Directors. Once approved, the company records the transfer in the Register of Members and issues a new share certificate to the transferee. Timely compliance and proper documentation are very important to ensure the transfer is legally valid.

Improper or incomplete share transfer documentation may result in rejection, penalties or internal conflicts among shareholders. BizGlobal assists companies and shareholders in drafting transfer documents, calculating stamp duty, preparing SH 4, conducting board meetings, updating statutory registers and ensuring complete legal compliance so that the share transfer is smooth and risk free.